Register a Alpha Capital account and connect it to your blockchain through an API. We care about your safety. All user data is encrypted and we never have permission to sensitive actions like withdrawal.

Create your account >

You can easily set up, update and test your strategy, in clicks. Change your diversifation, the rebalancing frequency, or your stop-loss percentage.Alpha Capital is highly customizable.

Create your account >

Sit back, relax and watch your money on autopilot. While maintaining 100% ownership of your money and account, we take care of the effort needed to make you a smarter investor.

Create your account >

Our decentralized compliance infrastructure connects registries, validators, and monitoring agents into a single policy layer. Every node remains sovereign, but policy signals and attestations flow across the network in real time to enforce rules, prevent abuse, and document accountability.

From identity verification and sanctions screening to operational thresholds and audit trails, the system is designed to keep participation safe, transparent, and regulation-ready across jurisdictions.

Composable rulebooks that can be updated without downtime, mapped to regions, risk tiers, and asset classes.

Cryptographic proofs of compliance events that can be verified independently by auditors and partners.

Live risk scoring, anomaly detection, and automated escalation paths to keep operations resilient.

Standardized endpoints for exchanges, custodians, and portfolio tools. Integrate once and enforce policies everywhere.

Region-aware policy packs keep nodes aligned with local regulations while preserving global scale.

Immutable logs and attestations create a continuous audit trail for clients, regulators, and internal governance.

Selective disclosure and threshold proofs reduce data exposure while meeting verification requirements.

Automated risk gates, circuit breakers, and policy-driven throttles that protect capital under stress.

Operator dashboards and review queues ensure high-impact decisions remain supervised and accountable.

Alpha Capital runs on decentralized compliance infrastructure so every strategy is coordinated, transparent, and auditable. Choose advanced tools that fit your risk profile and let the platform automate the heavy lifting.

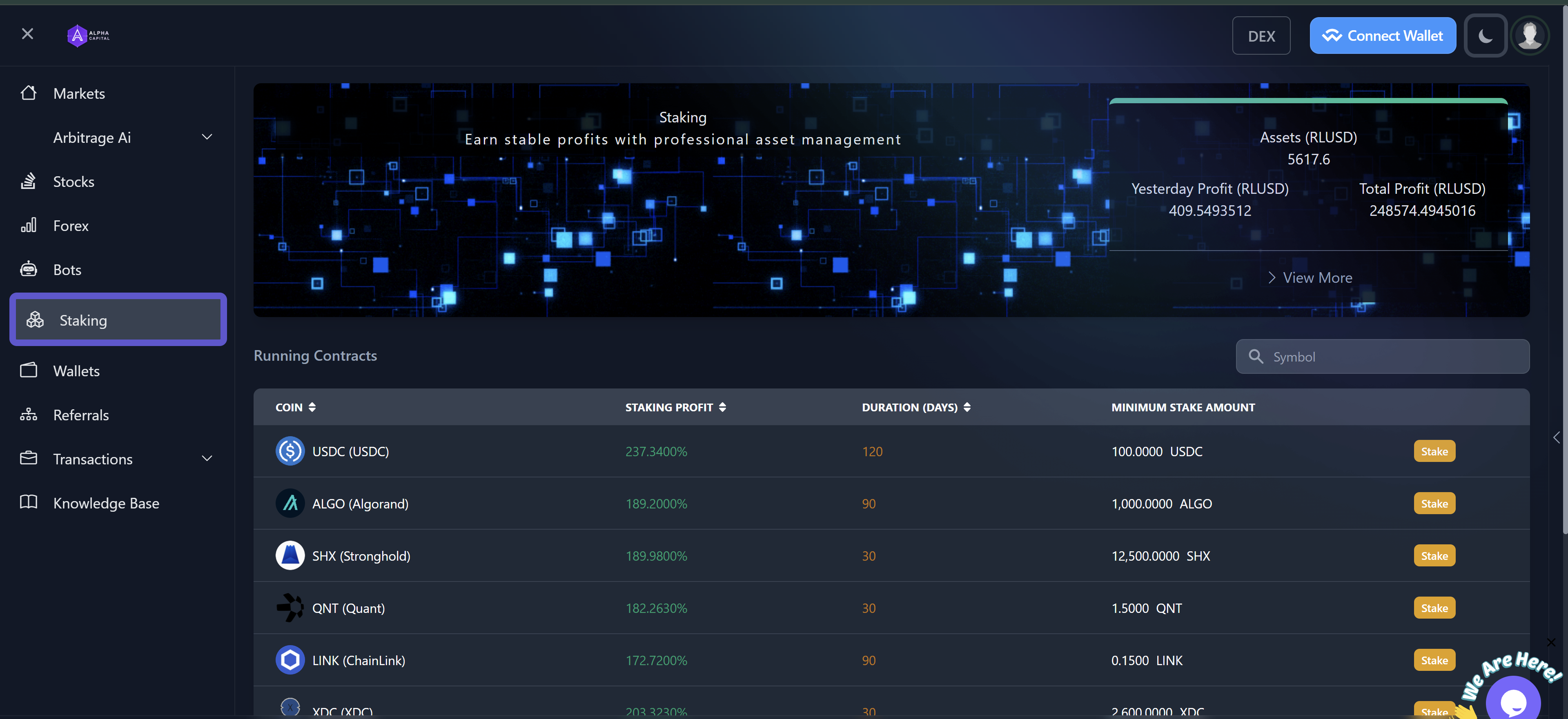

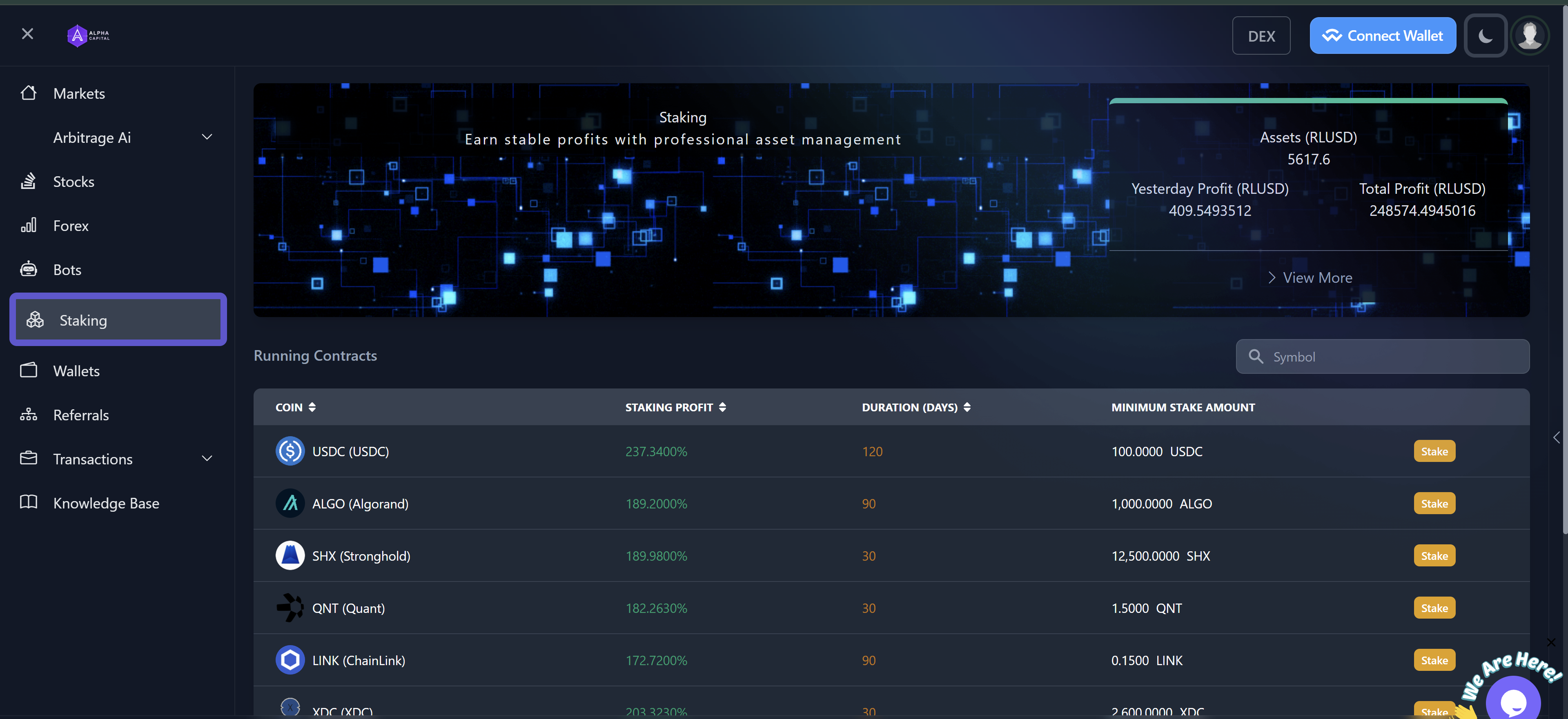

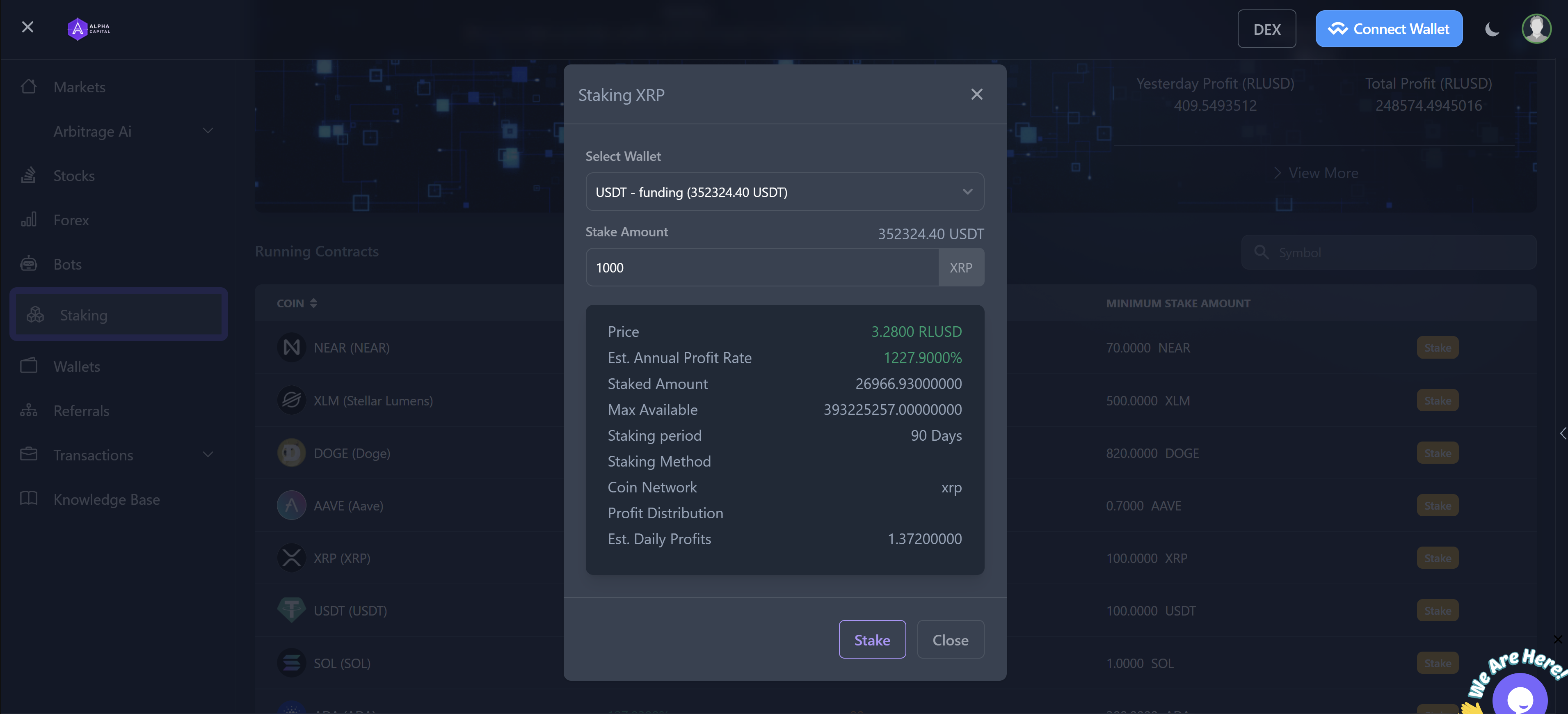

Allocate funds to proof-of-stake networks and earn protocol rewards while helping secure the network. We handle validator selection, reward tracking, and compliance checks so your allocations stay healthy and dependable.

Smart signals monitor market conditions, volatility, and network metrics to rebalance your portfolio automatically. The system adapts in real time and keeps your diversification targets aligned with your goals.

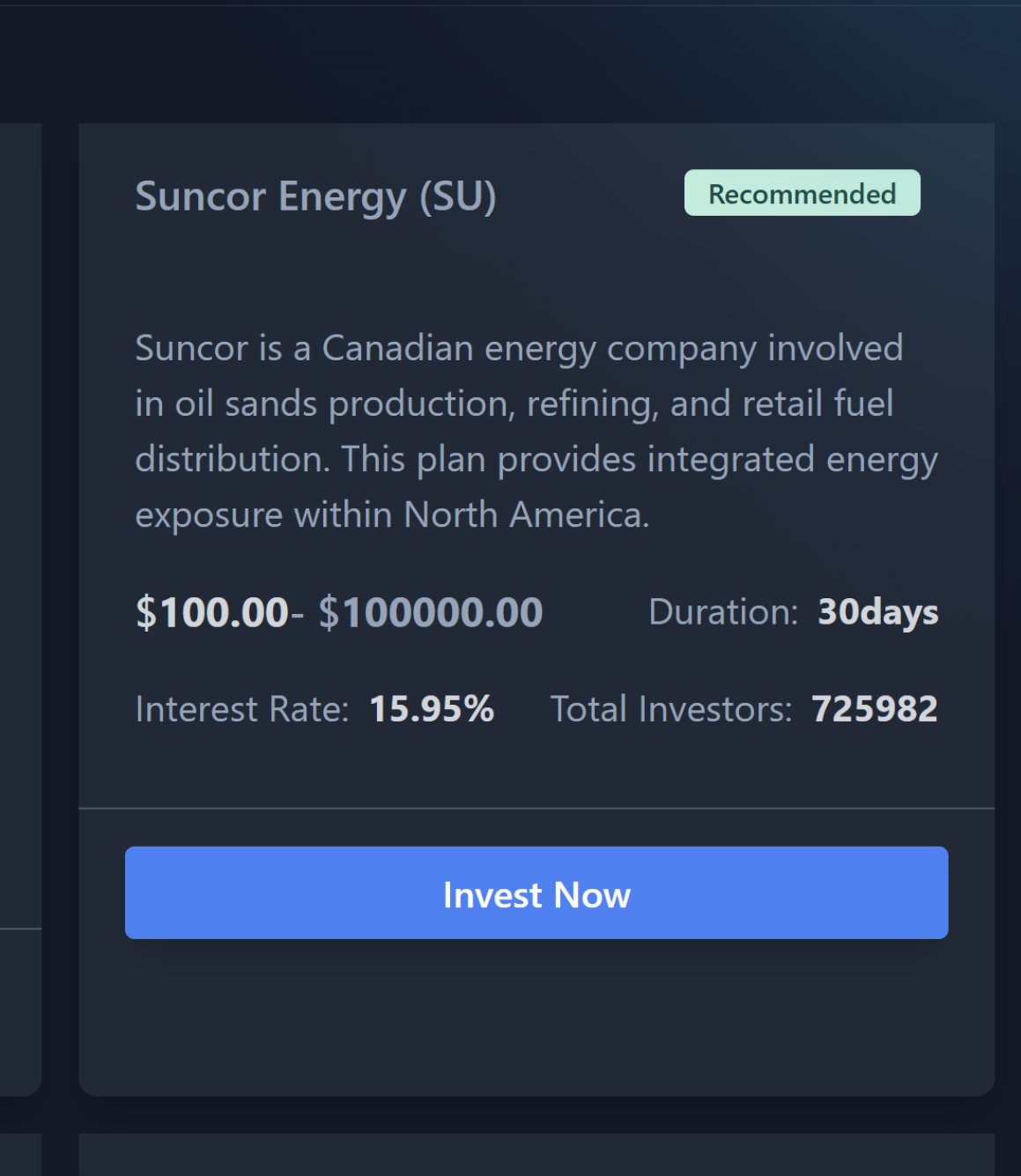

Energy market exposure with structured oversight, pricing intelligence, and disciplined risk management across cycles.

Trade major currency pairs with automated risk controls, real-time monitoring, and transparent reporting. Alpha Capital balances exposure across sessions and adjusts allocations to keep volatility in check.

Buy and sell spot positions with structured execution tools, portfolio guardrails, and compliance-first tracking so every trade is documented and aligned with your strategy.

Invite new users and earn rewards. Receive a 20% bonus on all new users you bring to the platform, tracked in your dashboard for full transparency.

We want to give you the best investing experience. We highly recommend a minimum of investment based on the level of diversification of your portfolio.

Up to 5 assets with a focused allocation mix.

Up to 10 assets to balance risk and growth.

Up to 20 assets for maximum coverage.

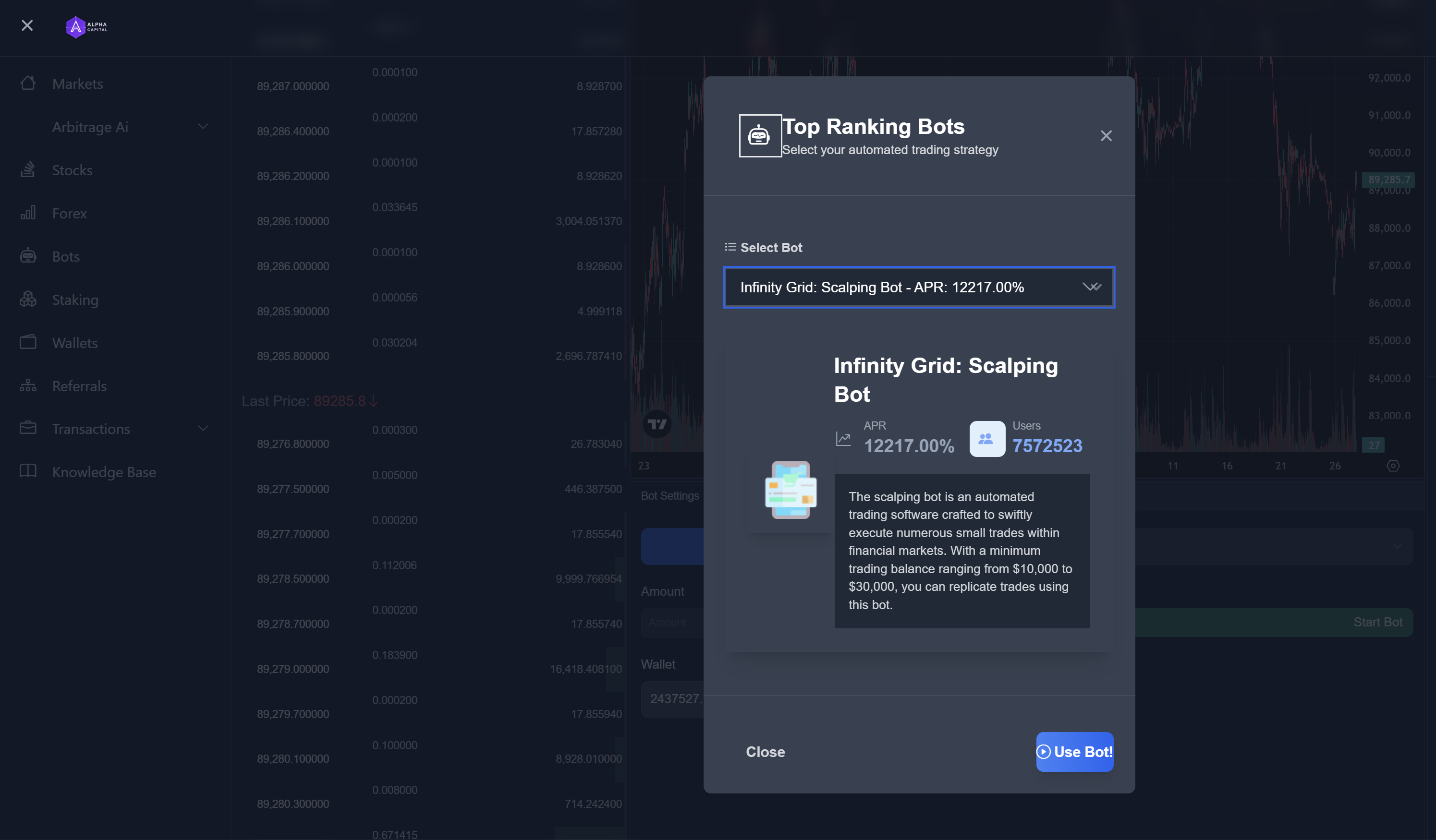

See how the automation bot monitors live conditions, runs your allocation logic, and keeps your strategy on track without constant manual updates.

Position into dividend-situated stocks designed to deliver steady income alongside long-term growth. Alpha Stock focuses on reliable payouts, diversified exposure, and disciplined risk controls to support good ROI across market cycles.

Explore trade workflows, portfolio allocation, and automated strategy controls before committing capital.

Simulate strategy changes, track mock performance, and see how allocation rules respond to volatility.

Test drawdown limits, diversification settings, and rebalancing schedules before you go live.

Hands-on practice shortens the learning curve and helps you commit to a strategy with clarity.

Experiment safely to avoid mistakes that can impact real capital when markets move quickly.

Confirm that your goals, time horizon, and risk profile are reflected in your portfolio setup.

Official announcements, press coverage, and syndicated releases from Alpha Capital LLC.

AlphaCapitalOne.com announces major oil & gas collaboration and cross-border energy partnership across the United States and Canada.

Independent outlets covering the announcement. Scroll to explore the full list of sources.